But the Essex-based firm’s powerhouse housing maintenance and upkeep division helped cushion the blow, with strong demand from councils and social landlords driving a 15% uplift in group turnover to almost £200m in the year to March 2025.

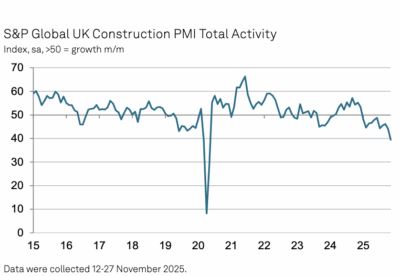

Mulalley said the development landscape had become increasingly hostile as stalled viability, high mortgage rates and the growing weight of Building Safety Act regulations left clients delaying or cancelling schemes altogether.

Sales rates remained sluggish, interest costs rose and the cost of compliance continued to escalate.

At the same time, councils and housing associations shifted their investment priorities, accelerating refurbishment, decent homes and fire-safety programmes. This surge in lower-risk upgrade workstreams helped offset the collapse in new-build activity, where high borrowing costs and tightening regulatory gateways continue to choke the pipeline.

Chief executive Eamon O’Malley said: “Despite the challenges, the directors are pleased to report another year of satisfactory trading for the company.

“While turnover and profitability have been under pressure, we have maintained positive operations and secured substantial forward workload in lower risk sectors at margins consistent with our trading expectations.”

In response to the turbulent market, Mulalley has paused bidding on further local authority new-build schemes until its current developments are completed. Instead, the contractor is doubling down on its most resilient income streams in long-term refurbishment, planned maintenance and decent homes work where funding remains stable and demand continues to grow.

The strategy is reflected in Mulalley’s £991m forward order book, bolstered by multi-year public-sector frameworks worth hundreds of millions. Cash performance was another bright spot, swinging from a £10m net overdraft to £20.5m in hand at year-end.

O’Malley added: “We remain confident that our diverse mix of businesses, supported by a strong balance sheet and a big secured forward workload, places us in an excellent position to take advantage of opportunities when market conditions stabilise.”